哪怕只上过几节IB经济课的IB新人也会发现,定义对于经济课程的学习是非常重要的。可以说,掌握了定义就掌握了IB经济考试7分的捷径。本文就针对微观经济这个版块,分享一下相关定义的整理,希望大家都能在IB经济考试中发挥出色。

● IB经济学HL考试包括3个Paper,各Paper成绩占比:P1 – 30%、 P2 – 30%、 P3 – 20%。

● IB经济学SL考试包括2个Paper,各Paper成绩占比:P1 – 40%;P2 – 40%。

● 还有20%的分数来自于你的经济学IA。

Paper 1 –论文

● 考试时长:1小时30分钟+ 5分钟阅读时间,5分钟的阅读时间内不得答题。

● Paper 1试题结构:

(1)A部分:选择2个问题中的1个作答,涉及课程提纲中微观经济学部分。(2)B部分:选择2个问题中的1个作答,涉及课程提纲中宏观经济学部分。(3 )A和B部分中的每个问题均包含(a)和(b)两部分题目,题目均是必修部分内容。(a)部分通常是“解释”类型的问题。(b)部分主要是“讨论”或“评估”类型的题目。

Paper 2 –数据响应

● 考试时长:1小时30分钟+ 5分钟阅读时间,5分钟的时间不允许答题。

● Paper 2试题结构:

(1)A部分:选择2个问题中的1个作答,涉及IB经济课程的国际经济学部分。(2)B部分:选择2个问题中的1个作答,涉及IB经济课程的发展经济学部分。

(3)A和B部分中的每个问题都由四个部分(a)、(b)、(c)和(d)组成,试题内容均为必修内容。(a)部分通常会要求定义2个经济术语。(b)和(c)部分考察“解释”类型问题。(d)部分将主要是“评估”或“讨论”类型问题。

Paper 3 –数学Paper(仅HL)

● 考试时长:1小时+ 5分钟的阅读时间,5分钟的阅读时间内不得答题。

● Paper 3的出题结构:

小伙伴们要从3个问题中选择2个作答,这些问题涵盖了课程提纲中的所有IB经济学HL部分:微观经济学、宏观经济学、国际经济学和发展经济学。

1abnormal profit

Refers to positive economic profit, arising when total revenue is greater than total economic costs (implicit plus explicit costs); is also known as ‘supernormal profit’. Also known as economic profit. (HL)

2ad valorem taxes

Taxes calculated as a fixed percentage of the price of the good or service; the amount of tax increases as the price of the good or service increases.

3allocative efficiency

The condition when P = MC (price is equal to marginal cost).

4break-even point

The point of production of a firm where its total revenue is exactly equal to its total costs (economic costs), and it is therefore earning normal profit, or zero economic (supernormal) profit (HL)

5ceteris paribus

A Latin expression that means ‘other things being equal’. Another way of saying this is that all other things are assumed to be constant or unchanging.

6collusion

An agreement among firms to fix prices, or divide the market between them, so asto limit competition and maximise profit; usually involves firms in oligopoly.(HL)

7competitive market

A market composed of many buyers and sellers acting independently, none of whom has any ability to influence the price of the product (i.e. no market power).

8complements (complementary goods)

Two or more goods that tend to be used together. If two goods are complements, an increase in the price of one will lead to a decrease in the demand of the other.

9consumer surplus

Refers to the difference between the highest prices consumers are willing to pay for agood and the price actually paid.

10cross-price elasticity of demand (XED)

A measure of the responsiveness of the demand for one good to a change in the price of another good; measured by the percentage change in the quantity of one good demanded divided by the percentage change in the price of another good.

11demand

Indicates the various quantities of a good that consumers (or a consumer) are willing and able to buy at different possible prices during a particular time period, ceteris paribus.

12demerit goods

Goods that are considered to be undesirable for consumers and are over-provided by the market. Reasons for overprovision may be that the goods have negative externalities,.

13direct taxes

Taxes paid directly to the government tax authorities by the taxpayer, including personal income taxes, corporate incometaxes and wealth taxes.

14diseconomies of scale

Increases in the average costs of production that occur as a firm increases its output by varying all its inputs (i.e. in the long run). (HL)

15economic costs

The sum of explicit costs and implicit costs, or the total opportunity costs incurred by a firm for its use of resources. (HL)

16economics

The study of choices leading to the best possible use of scarce resources in order to best satisfy unlimited human needs and wants.

17elasticity

In general, this is a measure of the responsiveness or sensitivity of a variable to changes in any of the variable’s determinants.

18equilibrium

A state of balance such that there is no tendency to change.

19excludable

A characteristic of goods according to which it is possible to exclude people from using the good by charging a price for it; if someone is unwilling or unable to pay the price they will be excluded from using it.

20explicit costs

Costs of production that involve a money payment by a firm to an outsider in order to acquire a factor of production that is not owned by the firm. (HL)

21externality

Occurs when the actions of consumers or producers give rise to positive or negative side-effects on other people who are not part of these actions, and whose interests are not taken into consideration.

22government intervention

The practice of government to intervene in markets, preventing the free functioning of the market, usually for the purpose of achieving particular economic or social objectives.

23implicit costs

Costs of production involving sacrificed income arising from the use of self-owned resources by a firm. (HL)

24income elasticity of demand

A measure of the responsiveness of demand to changes in income; measured by the percentage change in quantity demanded divided by the percentage change in price.

25indirect taxes

Taxes levied on spending to buy goods and services.

26inferior good

A good the demand for which varies negatively (or indirectly) with income; this means that as income increases, the demand for the good decreases.

27law of demand

A law stating that there is a negative causal relationship between the price of a good and quantity of the good demanded,over a particular time period, ceteris paribus.

28long run

In microeconomics, it is a time period in which all inputs can be changed; there are no fixed inputs. (HL)

29luxuries

Goods that are not necessary or essential; they have an income elastic demand greater than 1 (YED>1).

30marginal private benefits (MPB)

The extra benefit received by consumers when they consume one more unit of a good.

31marginal social costs (MSC)

The extra costs to society of producing one more unit of a good.

32market

Any kind of arrangement where buyers and sellers of a particular good, service or resource are linked together to carry out an exchange.

33market failure

Occurs when the market fails to allocate resources efficiently, or to provide the quantity and combination of goods and services mostly wanted by society. .

34microeconomics

The branch of economics that examines the behaviour of individual decision-making units, consumers and firms; is concerned with consumer and firm behaviour and how their interactions in markets determine prices in goods markets and resource markets.

35monopolistic competition

One of the four market structures, with the following characteristics: a large number of firms; substantial control over market price; product differentiation; no barriers toentry. (HL)

36natural monopoly

A single firm (a monopoly) that can produce for the entire market at a lower average cost than two or more smaller firms. (HL)

37necessities

Goods that are necessary or essential: they have an income inelastic demand (YED<1).

38non-price competition

Occurs when firms compete with each other on the basis of methods other than price (such as product differentiation, advertising and branding). (HL)

39normal good

A good the demand for which varies positively (ordirectly) with income; this means that as income increases, demand for the good increases.

40normative economics

The body of economics based on normative statements, which involve beliefs, or value judgements about what ought to be.

41oligopoly

One of the four market structures, with the following characteristics: small number of large firms in the industry; firms have significant control over price; firms are interdependent; products may be differentiated or homogeneous; there are high barriers to entry. (HL)

42opportunity cost

The value of the next best alternative that must be given up or sacrificed in order to obtain something else.

43perfect competition

One of the four market structures, with the following characteristics: a large number of small firms; no control overprice; all firms sell a homogeneous product; no barriers to entry, perfect information and perfect resource mobility. (HL)

44positive economics

The body of economics based on positive statements, which are about things that are, were or will be.

45price control

Setting of minimum or maximum prices by the government (or private organisations) so that prices are unable to adjust to their equilibrium level determined by demand and supply.

46price discrimination

The practice of charging a different price for thesame product when the price difference is not justified by differences in costs of production. (HL)

47price elasticity of demand (PED)

A measure of the responsiveness of the quantity of a good demanded to changes in its price, given by the percentage change in quantity demanded divided by the percentage change in price.

48price elasticity of supply (PES)

A measure of the responsiveness of the quantity of a good supplied to changes inits price, given by the percentage change in quantity supplied divided by the percentage change in price.

49producer surplus

Refers to the difference between the price received by firms for selling their good and the lowest price they are willing to accept to produce the good.

50productive efficiency

The condition for productive efficiency is that production takes place where ATC is minimum. (HL)

51progressive taxation

Taxation where, as income increases, the fraction of income paid as taxes increases.

52public good

A good that is non-rivalrous (its consumption by one person does not reduce consumption by someone else) and non-excludable (itis not possible to exclude someone from using the good).

53rivalrous

A characteristic of a good according to which its consumption by one person reduces its availability for someone else; most goods are rivalrous.

54scarcity

The condition in which available resources (land,labour, capital, entrepreneurship) are limited; they are not enough to produce everything that human beings need and want.

55specific tax

A tax calculated as an absolute amount per unit ofthe good or service sold.

56subsidy

An amount of money paid by the government to firms for a variety of reasons: to prevent an industry from failing, to support producers’ incomes.

57substitute goods

Two or more goods that satisfy a similar need, so that one good can be used in place of another..

58supply

Indicates the various quantities of a good that firms (or a firm) are willing and able to produce and sell at different possible prices during a particular time period, ceteris paribus .

59tradable permits

Permits that can be issued to firms by a government or an international body, and that can be traded (bought and sold)in a market, the objective being to limit the total amount of pollutants emitted by the firms.

60variable costs

Costs that arise from the use of variable inputs,and that vary or change as output increases or decreases. (HL)

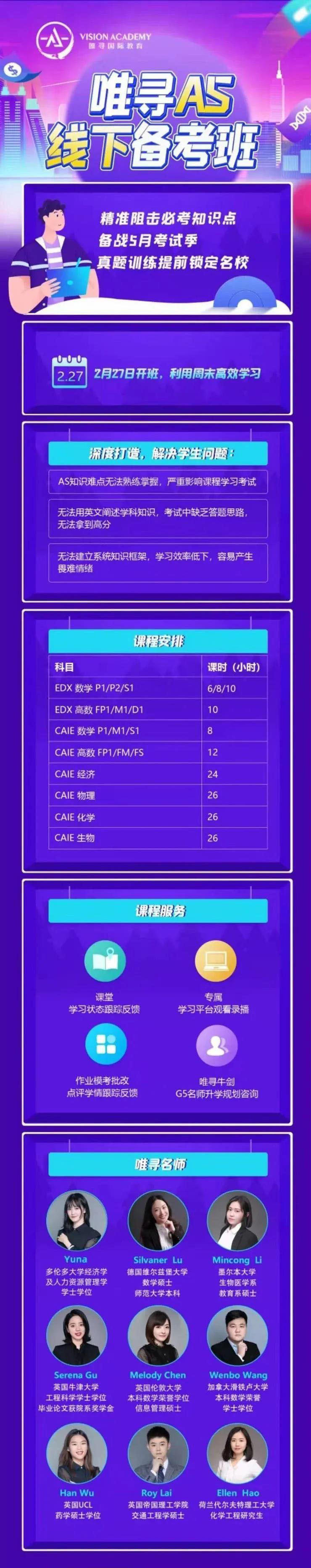

IB经济考试重要定义就分享到这里。2月份,IBO刚刚宣布今年IB将采取两种方案——正常考试,或者提交预估分。如果你的学校要正常考试,现在就可以开始复习啦,如果你的学校打算提交预估分,那平时成绩就要重视了。所以,提前进入“摸鱼”状态不可取,踏实学习才是真。如果你还不知道如何利用winter vacation做好复习,或是觉得兼顾平时成绩与论文很难,点击预约试听【IB复习冲刺班】——

唯寻教学天团授课,

紧贴官方新政策,

根据学校进度与学员能力定制课程,

对考纲知识点进行重新切片,

分数、学术双申提升,

还有TOK IA EE套餐类课程,

针对每个细节精准复习。

唯寻学员的IB平均分高达40.19,远超亚太地区及全球IB平均分。

现在报名还能领取线上1V1测评,私人定制冲7方案哟。

更多IB学习攻略点击

2021IB考试2月新方案公布:2种选择,考与不考或由学校决定

【文末福利】

扫码添加小唯,

转发本文至朋友圈,

集齐10个赞,

她就会给你发50篇TOK SAMPLE大礼包

↑ Tutor小唯 你的专属留学顾问↑

学习有方法,成长看得见

筑梦牛剑/G5/常春藤