今天给大家讲解的是来自IGCSE经济第26章的内容,这部分的内容主要讲了有关政府的收入与支出和一些有关财政的政策。同学们一起来和我们复习有关IGCSE经济政府知识点吧!

财政

Budget: the relationship between government revenue and government spending.

政府预算,即政府的财政收支计划。

Budget deficit: government spending is higher than government revenue.

财政赤字:财政收入小于财政支出。

Budget surplus: government revenue is higher than government spending.

财政盈余:财政收入大于财政支出。

National debt: the total amount the government has borrowed over time.

国家债务:国家债务是政府作为借债主体 (债务人) 所形成的债务。

政府开支的用途

一般而言,政府希望对宏观经济产生积极的影响,扮演一个管理者和调控者的身份,

主要功能如下:

To influence economic activity. A government may, for example, increase its spending in order to increase aggregate demand. Government spending can be a powerful government measure. This is because of the multiplier effect.刺激经济增长,政府开支对于GDP的增长有乘数效应。

To reduce market failure. Governments spend on public goods as this would not be financed by the private sector. 降低市场失灵的风险

To promote equity. 提升社会公平

To pay interest on national debt. 偿还政府债务

税

直接税Direct taxes&间接税Indirect taxes

政府的财政来源就是税收。税收按照征收方式可以分为直接税(Direct taxes)和间接税(Indirect taxes),它们的区别在于,直接税是不可被转嫁的税,而间接税(例如关税)经常被转嫁到消费者身上。

Direct taxes: taxes on income and wealth.

Indirect taxes: taxes on expenditure.

根据税率的变化,分为:

累进税(Progressive tax)即税率随着税额增加不断递增的税;

累退税(Regressive tax)即税率会随着税额增加不断变低的税;

比例税(Proportional tax)也就是税率不随税基的变动而变动的一种税收.

政府征税调控商品的供需关系

政府征税往往被视作是对一个地区进行有效管理的象征,从经济的角度上说,政府征税可以更好的调控商品的供需关系,具体功用如下:

To redistribute income from the rich to the poor. 提升社会公平

To discourage the consumption of demerit goods. 降低消费者对特定商品的需求

To raise the costs of firms that impose costs on others by, for example, causing pollution. 增加特定企业的成本(例如,排污较多的企业)

To discourage the consumption of imports and hence protect domestic industries. (降低对进口产品的需求,保护本国产品)

To influence economic activity. As with government spending, changes in taxation can be used to change aggregate demand. (影响经济总需求)

税务的准则

Equity, means fairness in the sense that the amount of tax people and firms have to pay.

Certainty. A tax should be easy to understand, and households and firms should be able to calculate the amount of tax required to be paid by them.

Convenience. A tax should be easy to pay.

Economy. The cost of collecting a tax should be considerably less than the revenue

Flexibility. It should be possible to change the tax if economic activity changes or government aims change.

Efficiency. A tax should improve the performance of markets or at least not significantly reduce the efficiency of markets.

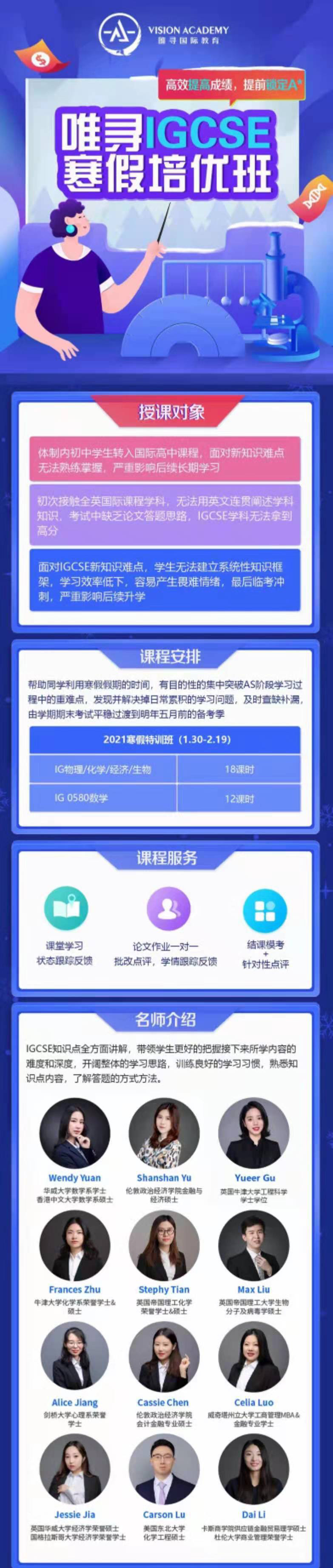

Fiscal policy: decisions on government spending and taxation designed to influence aggregate demand.

以上就是给大家带来的一些有关政府的知识点了,当然也非常推荐同学们利用空暇的时间看看一些经济了类书籍,因为能够对你学习IG经济起到非常好的帮助作用。如果你觉得以上的知识点无法满足您目前的学习状态,您也可以前来唯寻找导师切磋哦,唯寻的导师毕业于经济知名大学,(Ruby导师的学员有8位都被剑桥经济系录取了)一定能够给你带来专业的帮助。点击【预约试听】即可报名。

点击

IGCSE经济参考书目推荐 这几本参考书可是经济学人鼎力推荐

查看。

学习有方法,成长看得见

筑梦牛剑/G5/常春藤