今年的IB大考还有几个月的时间,不知道同学们都复习好了吗?经济作为IB课程中比较重要的一门科目,向来就受到了无数的重视。下面给大家总结了一波IB微观经济定义,如果您也有复习的需要,那就赶紧看看这些常考的IB微观经济定义吧!

Refers to positive economic profit, arising when total revenue is greater than total economic costs (implicit plus explicit costs); is also known as ‘supernormal profit’. Also known as economic profit. (HL)

Taxes calculated as a fixed percentage of the price of the good or service; the amount of tax increases as the price of the good or service increases.

The condition when P = MC (price is equal to marginal cost).

The point of production of a firm where its total revenue is exactly equal to its total costs (economic costs), and it is therefore earning normal profit, or zero economic (supernormal) profit (HL)

A Latin expression that means ‘other things being equal’. Another way of saying this is that all other things are assumed to be constant or unchanging.

An agreement among firms to fix prices, or divide the market between them, so asto limit competition and maximise profit; usually involves firms in oligopoly.(HL)

A market composed of many buyers and sellers acting independently, none of whom has any ability to influence the price of the product (i.e. no market power).

Two or more goods that tend to be used together. If two goods are complements, an increase in the price of one will lead to a decrease in the demand of the other.

Refers to the difference between the highest prices consumers are willing to pay for agood and the price actually paid.

A measure of the responsiveness of the demand for one good to a change in the price of another good; measured by the percentage change in the quantity of one good demanded divided by the percentage change in the price of another good.

Indicates the various quantities of a good that consumers (or a consumer) are willing and able to buy at different possible prices during a particular time period, ceteris paribus.

Goods that are considered to be undesirable for consumers and are over-provided by the market. Reasons for overprovision may be that the goods have negative externalities,.

Taxes paid directly to the government tax authorities by the taxpayer, including personal income taxes, corporate incometaxes and wealth taxes.

Increases in the average costs of production that occur as a firm increases its output by varying all its inputs (i.e. in the long run). (HL)

The sum of explicit costs and implicit costs, or the total opportunity costs incurred by a firm for its use of resources. (HL)

The study of choices leading to the best possible use of scarce resources in order to best satisfy unlimited human needs and wants.

In general, this is a measure of the responsiveness or sensitivity of a variable to changes in any of the variable’s determinants.

A state of balance such that there is no tendency to change.

A characteristic of goods according to which it is possible to exclude people from using the good by charging a price for it; if someone is unwilling or unable to pay the price they will be excluded from using it.

explicit costs

Costs of production that involve a money payment by a firm to an outsider in order to acquire a factor of production that is not owned by the firm. (HL)

externality

Occurs when the actions of consumers or producers give rise to positive or negative side-effects on other people who are not part of these actions, and whose interests are not taken into consideration.

government intervention

The practice of government to intervene in markets, preventing the free functioning of the market, usually for the purpose of achieving particular economic or social objectives.

implicit costs

Costs of production involving sacrificed income arising from the use of self-owned resources by a firm. (HL)

income elasticity of demand

A measure of the responsiveness of demand to changes in income; measured by the percentage change in quantity demanded divided by the percentage change in price.

indirect taxes

Taxes levied on spending to buy goods and services.

inferior good

A good the demand for which varies negatively (or indirectly) with income; this means that as income increases, the demand for the good decreases.

law of demand

A law stating that there is a negative causal relationship between the price of a good and quantity of the good demanded,over a particular time period, ceteris paribus.

long run

In microeconomics, it is a time period in which all inputs can be changed; there are no fixed inputs. (HL)

luxuries

Goods that are not necessary or essential; they have an income elastic demand greater than 1 (YED>1).

marginal private benefits (MPB)

The extra benefit received by consumers when they consume one more unit of a good.

marginal social costs (MSC)

The extra costs to society of producing one more unit of a good.

market

Any kind of arrangement where buyers and sellers of a particular good, service or resource are linked together to carry out an exchange.

market failure

Occurs when the market fails to allocate resources efficiently, or to provide the quantity and combination of goods and services mostly wanted by society.

microeconomics

The branch of economics that examines the behaviour of individual decision-making units, consumers and firms; is concerned with consumer and firm behaviour and how their interactions in markets determine prices in goods markets and resource markets.

monopolistic competition

One of the four market structures, with the following characteristics: a large number of firms; substantial control over market price; product differentiation; no barriers toentry. (HL)

natural monopoly

A single firm (a monopoly) that can produce for the entire market at a lower average cost than two or more smaller firms. (HL)

necessities

Goods that are necessary or essential: they have an income inelastic demand (YED<1).

non-price competition

Occurs when firms compete with each other on the basis of methods other than price (such as product differentiation, advertising and branding). (HL)

normal good

A good the demand for which varies positively (ordirectly) with income; this means that as income increases, demand for the good increases.

normative economics

The body of economics based on normative statements, which involve beliefs, or value judgements about what ought to be.

oligopoly

One of the four market structures, with the following characteristics: small number of large firms in the industry; firms have significant control over price; firms are interdependent; products may be differentiated or homogeneous; there are high barriers to entry. (HL)

opportunity cost

The value of the next best alternative that must be given up or sacrificed in order to obtain something else.

perfect competition

One of the four market structures, with the following characteristics: a large number of small firms; no control overprice; all firms sell a homogeneous product; no barriers to entry, perfect information and perfect resource mobility. (HL)

positive economics

The body of economics based on positive statements, which are about things that are, were or will be.

price control

Setting of minimum or maximum prices by the government (or private organisations) so that prices are unable to adjust to their equilibrium level determined by demand and supply.

price discrimination

The practice of charging a different price for thesame product when the price difference is not justified by differences in costs of production. (HL)

price elasticity of demand (PED)

A measure of the responsiveness of the quantity of a good demanded to changes in its price, given by the percentage change in quantity demanded divided by the percentage change in price.

price elasticity of supply (PES)

A measure of the responsiveness of the quantity of a good supplied to changes inits price, given by the percentage change in quantity supplied divided by the percentage change in price.

producer surplus

Refers to the difference between the price received by firms for selling their good and the lowest price they are willing to accept to produce the good.

productive efficiency

The condition for productive efficiency is that production takes place where ATC is minimum. (HL)

progressive taxation

Taxation where, as income increases, the fraction of income paid as taxes increases.

public good

A good that is non-rivalrous (its consumption by one person does not reduce consumption by someone else) and non-excludable (itis not possible to exclude someone from using the good).

rivalrous

A characteristic of a good according to which its consumption by one person reduces its availability for someone else; most goods are rivalrous.

scarcity

The condition in which available resources (land,labour, capital, entrepreneurship) are limited; they are not enough to produce everything that human beings need and want.

specific tax

A tax calculated as an absolute amount per unit ofthe good or service sold.

subsidy

An amount of money paid by the government to firms for a variety of reasons: to prevent an industry from failing, to support producers’ incomes.

substitute goods

Two or more goods that satisfy a similar need, so that one good can be used in place of another..

supply

Indicates the various quantities of a good that firms (or a firm) are willing and able to produce and sell at different possible prices during a particular time period, ceteris paribus .

tradable permits

Permits that can be issued to firms by a government or an international body, and that can be traded (bought and sold)in a market, the objective being to limit the total amount of pollutants emitted by the firms.

variable costs

Costs that arise from the use of variable inputs,and that vary or change as output increases or decreases. (HL)

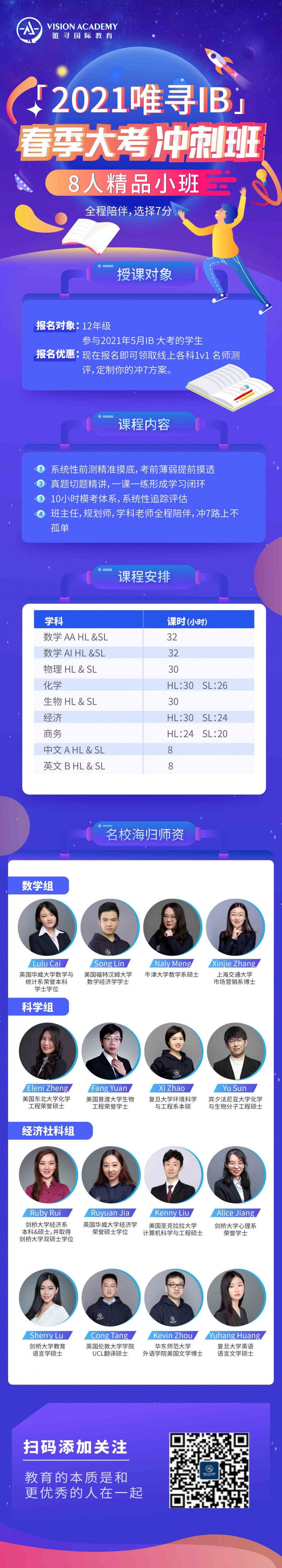

以上就是IB经济的定义了,大家要努力复习了。纵观唯寻今年被牛剑录取的113位学员,他们的IB预估分都在42左右,也就是说IB40+才是一个比较有竞争力的分数。如果你离这个标准始终有一段距离,点击预约试听【IB同步培训班】,毕业于全球知名大学的IB导师领衔授课,唯寻学员的IB平均分是40.19,领先全球平均分10分!

点击

查看。

学习有方法,成长看得见

筑梦牛剑/G5/常春藤